Introducing A New Era Of Business Lending

We are transforming the idea of business lending and have created a streamlined application process for our clients. Our goal is to help you to achieve your business goals. Because when you succeed, we succeed.

Your business is one-of-a-kind, and requires a tailored solution.

Free. Unless Funded.

Our service is 100% success based. We only charge fees when you successfully get funded through our lenders.

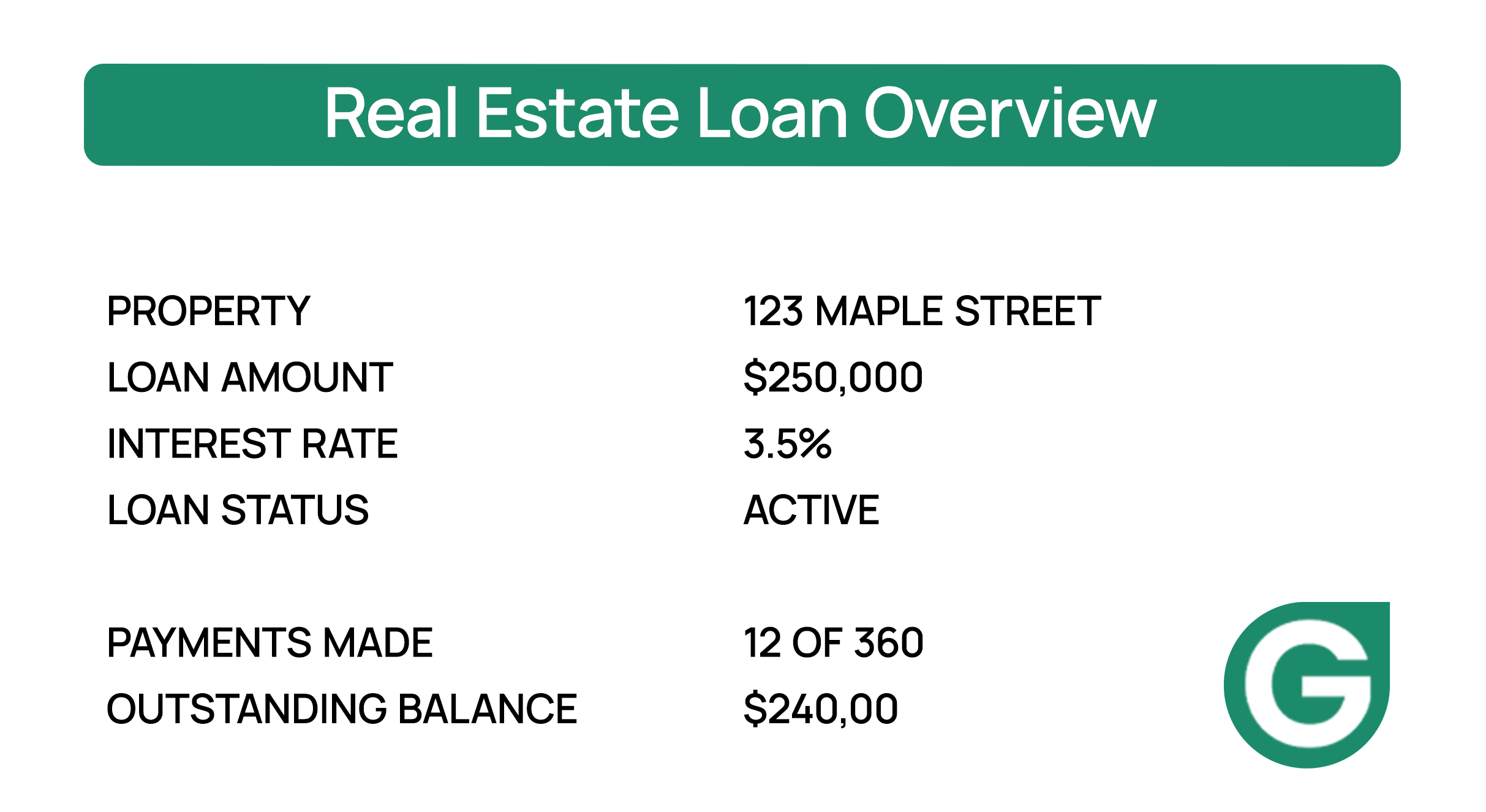

Large Loans at Low Interest Rates

We help businesses with great credit get SBA loans. Rates start at 5.25% and we fund loans up to $5 million. No other online lender can beat our loan terms guaranteed.

Fast, Simple and Secure

Utilize our secure software to prequalify in less than 5 minutes without impacting your credit score.

Find the Right Loan for your Business

We have relationships with the top business lenders in the industry. We go the extra mile to find you the best loan that meets your needs at affordable interest rates.

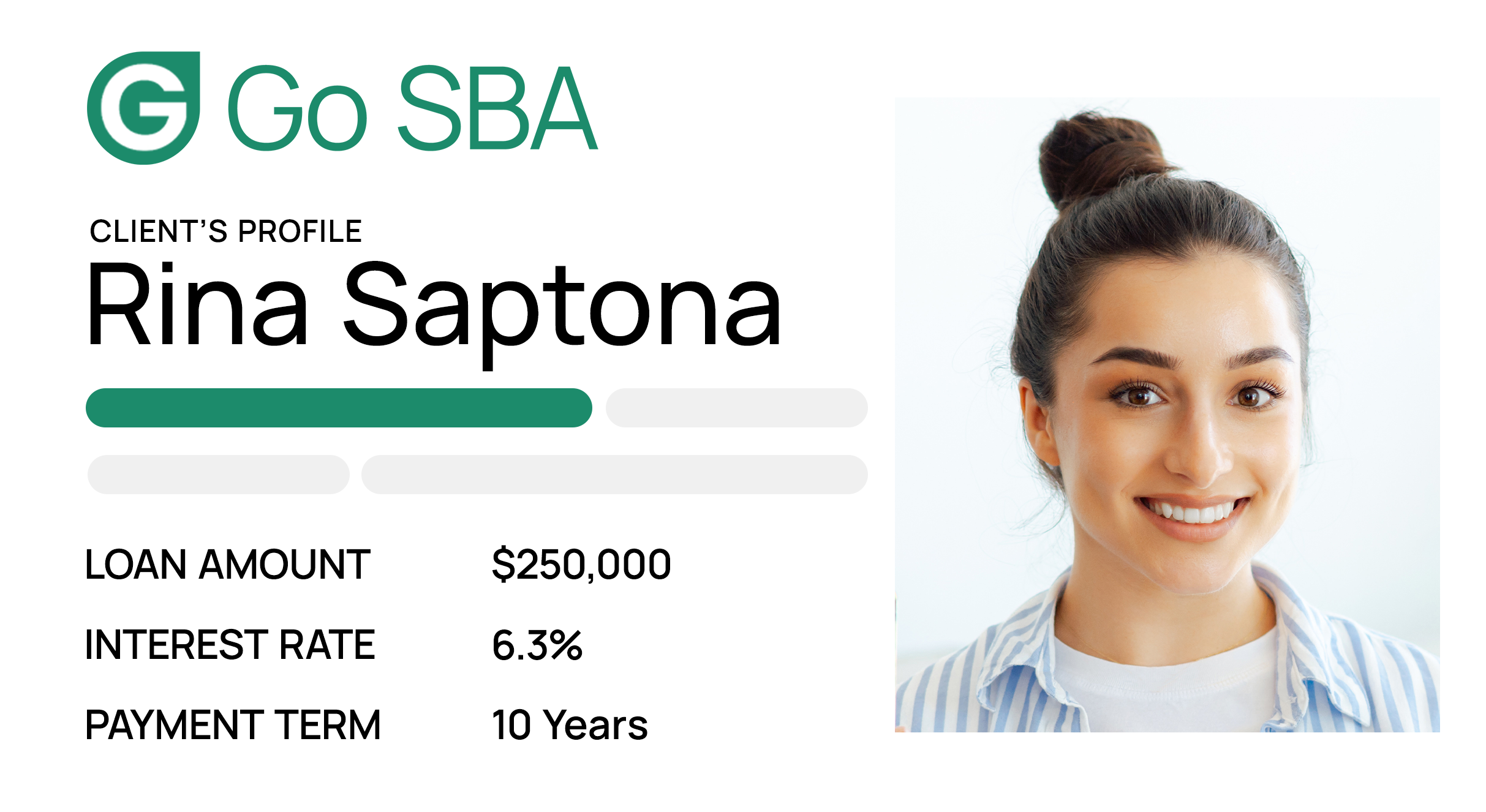

Business Loans To Match Your Needs

Our team of loan advisors will assist you in finding the best available loan with affordable monthly payments.

We Make Small Business Loans Easier, Faster, And Affordable.

Experience fast, hassle-free funding tailored to your business needs with our efficient four-step process.

Step 1: Contact Us

Chat with our team about your financing needs and start the process.

Step 2: Multiple Lenders

We take your file to multiple lenders and get multiple term sheets.

Step 3: Choose Lender

Choose the term sheet with the best terms and rates. When lenders compete, you win!

Step 4: Loan Funding

Our team will assist you with the loan closing and any questions the lender might have.

It can be overwhelming to get an SBA loan. You’ve come to the right place.

Join the thousands of businesses that trust us with their SBA financing needs. Leave the heavy lifting to us, you’re in good hands.

Total SBA loan amount approved & funded

Total SBA loans approved and funded

Time our average borrower saves working with us

Total interest payments our average borrower saves working with us

We'd love to hear from you.

At least three years of operating history and a minimum of $250K revenue is required. Have questions? We are only a call or email away.